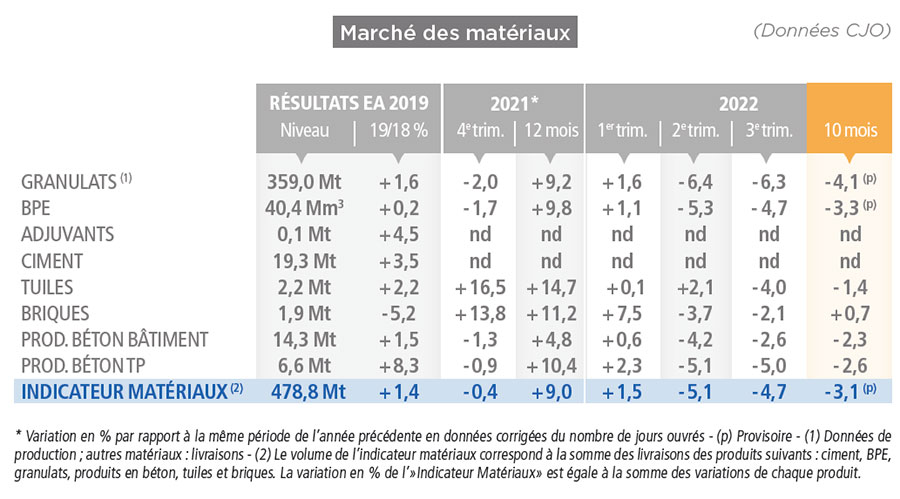

After a "complicated" year 2022 by the surge in energy consumed in crushers, professionals in building materials, aggregates and concrete are expecting a "new downturn in activity" in 2023, which would thus fall back almost to the level of covid year in 2020.

Selection of products

To read also

-

Launch of the Repairability Score for roller shutters, garage doors and automatic pedestrian doors

Launch of the Repairability Score for roller shutters, garage doors and automatic pedestrian doors

-

Concrete prefabrication, the right calculation to optimize construction sites

Concrete prefabrication, the right calculation to optimize construction sites

-

Eleven leading materials scientists call for massive decarbonization of the cement industry

Eleven leading materials scientists call for massive decarbonization of the cement industry

-

INOHA becomes co-publisher of Building for the Climate

INOHA becomes co-publisher of Building for the Climate

-

The biosourced materials sector is ready for the decarbonization of buildings

The biosourced materials sector is ready for the decarbonization of buildings

-

Aid for energy renovation: UFME proposes to adapt the eligibility criteria for windows to the existing residential stock

Aid for energy renovation: UFME proposes to adapt the eligibility criteria for windows to the existing residential stock

-

The Lighting Syndicate elects its new Board of Directors and its new Bureau

The Lighting Syndicate elects its new Board of Directors and its new Bureau

-

Alain Plantier elected new President of the National Union of Quarry Industries and Building Materials

Alain Plantier elected new President of the National Union of Quarry Industries and Building Materials

Popular News

-

Old property prices are still falling but a recovery is taking shape

Old property prices are still falling but a recovery is taking shape

-

A report on anticipating the effects of +4°C warming reaffirms the need for housing adaptation

A report on anticipating the effects of +4°C warming reaffirms the need for housing adaptation

-

AI is already revolutionizing businesses in architecture, engineering, construction... according to Autodesk's "State of Design & Make" study

AI is already revolutionizing businesses in architecture, engineering, construction... according to Autodesk's "State of Design & Make" study

-

The slowdown in the decline in mortgage rates continues

The slowdown in the decline in mortgage rates continues

Publi-editorial

-

Bjelin: wood and innovation as its DNA

Bjelin: wood and innovation as its DNA

-

Hydro'Way, Eco'Urba, StabiWay and Baltazar... permeable floor covering solutions from JDM Expert

Hydro'Way, Eco'Urba, StabiWay and Baltazar... permeable floor covering solutions from JDM Expert

-

Glass pergola: enjoy its outdoor spaces with elegance and modernity all year round

Glass pergola: enjoy its outdoor spaces with elegance and modernity all year round

-

EduRénov Plan: Rockwool unveils its Guide to successful energy renovation of school buildings

EduRénov Plan: Rockwool unveils its Guide to successful energy renovation of school buildings