The slowdown observed since the 4th quarter of 2021 has particularly accelerated in recent months to reach -6% over one year since August 2022, proof that the decline is now a trend.

Admittedly, the changes recorded from April 2021 to February 2022 had been very strong, but the increase in activity – with a peak of +23% over one year in August 2021 – is now well and truly over: the notaries had already detected at At that time, in addition to a post-confinement catch-up effect, a phenomenon of anticipation of future real estate changes over a usually longer period of time, the health crisis having played a role of catalyst and accelerator in real estate decision-making . The recent volume adjustment, which we are witnessing, reflects this forecast.

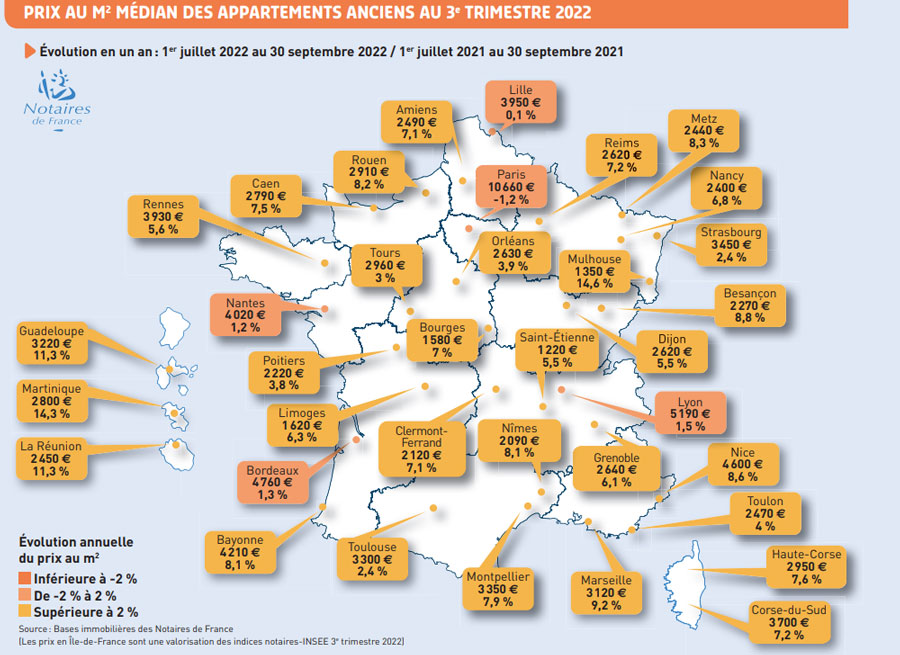

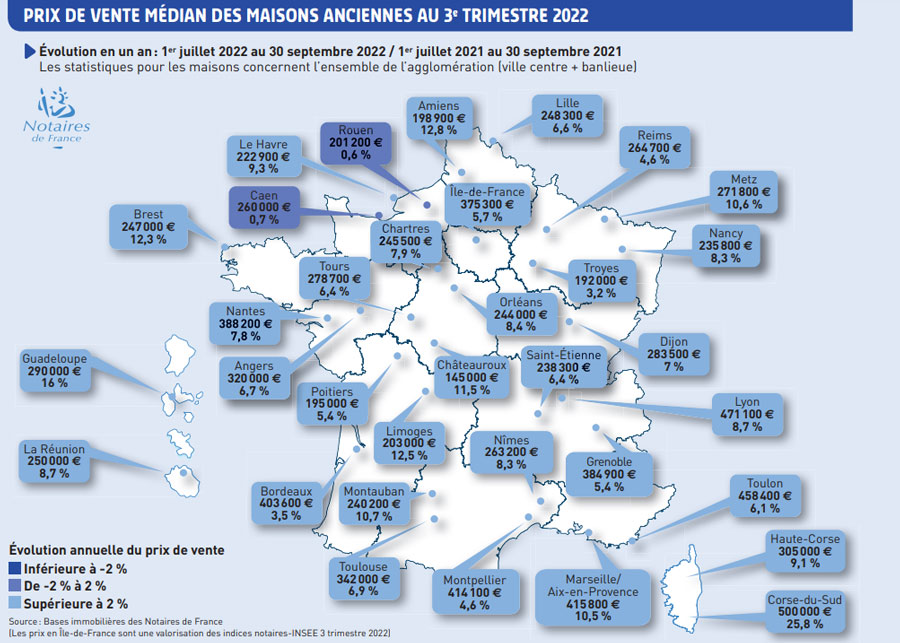

If the fall in volumes is triggered, this is not the case, far from it, for prices. The upward trend observed in previous quarters continues, whether for old apartments or old houses. Nevertheless, it can be noted that in the 3rd quarter of 2022, the amplitude of price changes is more contained. Notaries note the return of price negotiations, a sign of a softening of the rise and of a more balanced framework for discussions between sellers and buyers.

Energy performance is increasingly included in arguments helping price negotiations. The slowdown in the rise in prices of existing homes should also be significant at the end of February 2023, in particular for old houses which had increased more markedly when the lockdown came out. The post-lockdown “psychological reaction” seems to be slowly fading. Moreover, if at the end of 2021 the share of buyers from the Ile-de-France increased in the majority of French departments, the observation is different at the end of 2022, where their share stabilized or reduced in almost all the departments. The biggest falls are mainly observed in the departments bordering or close to Île-de-France, where the share of buyers from the Ile-de-France was the highest and where it had increased more sharply a year ago.

The real estate market, after experiencing peaks, is rebalancing, both by the end of the breath effect that appeared as a result of the health crisis and by the continuous rise in real estate rates which, by their extreme weakness, had largely boosted the market . It should be noted that inflation could continue to alter demand and therefore bring down volumes even more sharply, especially since it is likely to weigh on the "rest to live" of potential buyers, especially if the gap between rising wages and rising prices is significant. Furthermore, while the rate of wear may have caused tensions in recent months, the decision taken by the Banque de France, in agreement with the Ministry of the Economy and Finance, to revise it monthly from 1 February and until July 1, 2023 is to be welcomed, because it will certainly make it possible to better guarantee access to credit, if the banks are inclined to lend. Notwithstanding this technical measure, the continuous rise in interest rates excludes a growing number of people from the real estate market, faced with a greater demand for investment. Notaries have also noted an increase in the number of loan refusals and in particular, as shown by the figures of the Banque de France, a reduction in the share of first-time buyers in the production of housing loans for the acquisition of a main residence since December 2021 [1].

It is customary to say that the real estate year is done in the spring and the month of March will be decisive in the trajectory that the market will take. The confirmed start of the current decline in volumes and the deceleration in prices could only be the sign of a half-yearly adjustment and a return to normal, mirroring a year 2022 which has experienced a two-step unfolding with a very active first half and a second marked by dark macroeconomic parameters and sluggish consumer confidence. In any event, the real estate market could just as well continue to decline, in view of a significant number of clouds gathering above it, even as the appetite of the French for the stone-refuge is not denied. not.

In the 3nd quarter of 2022, the prices of existing housing decelerated slightly

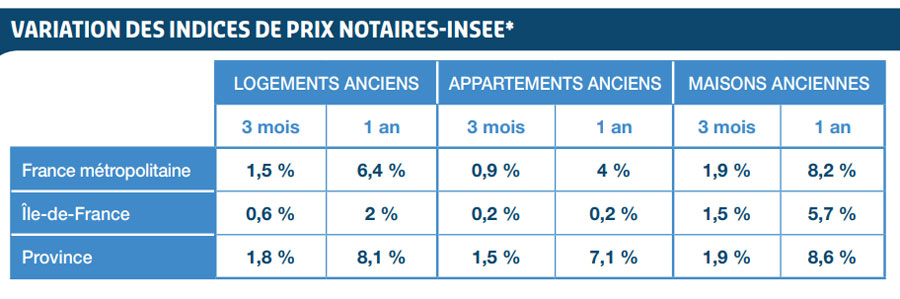

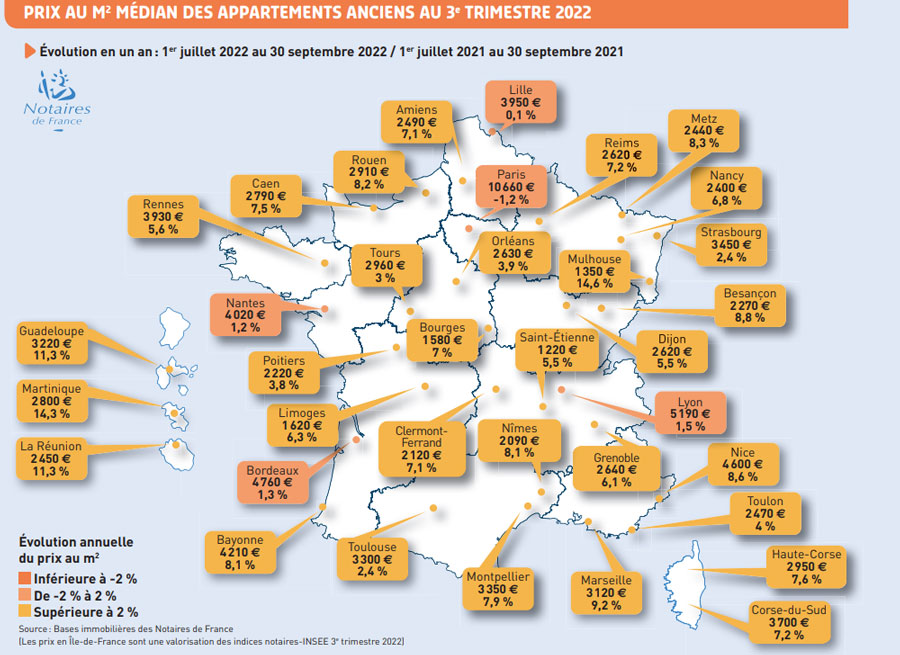

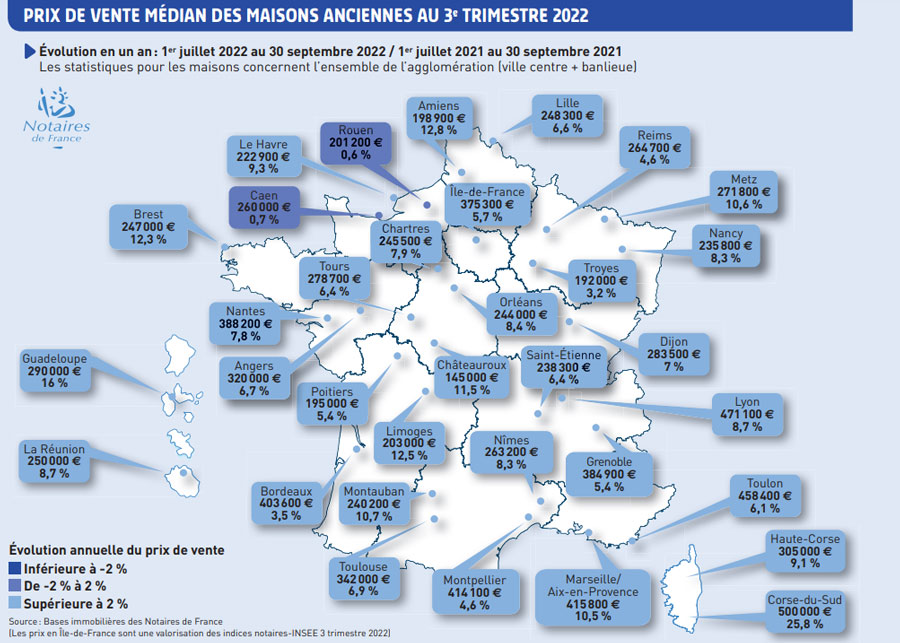

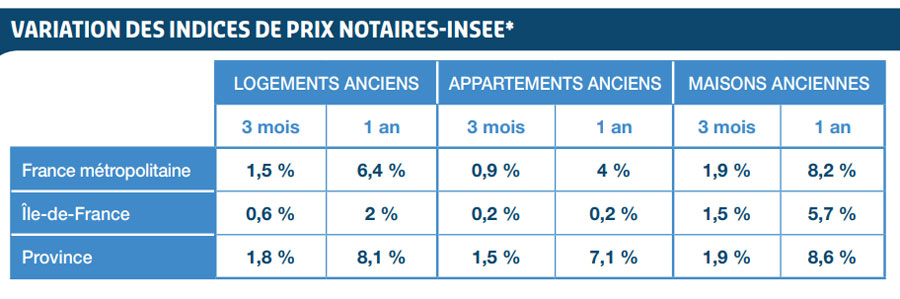

In the 3rd quarter of 2022, the rise in prices of existing homes in mainland France continued with +1,5% compared to the 2nd quarter of 2022 (provisional data corrected for seasonal variations). Over one year, prices decelerated slightly with +6,4%. The increase remains more marked for houses (+8,2% over one year) than for apartments (+4%) and this since the 4th quarter of 2020.

In the provinces, the rise in prices of existing homes continues at a rate comparable to the last two quarters. In the 3rd quarter of 2022, they increased by +1,8%. Over one year, prices remained very dynamic with +8,1%. Since the start of 2021, the prices of houses in the provinces (+8,6% over one year in the 3rd quarter of 2022) have increased more strongly than those of apartments (+7,1%), whereas it was the inverse in 2019 and 2020.

In Île-de-France, the prices of existing housing increased over one quarter for the third consecutive quarter with +3%. Over one year, prices also increased by +0,6%. This regular increase is much more marked for houses (+2% over one year) than for apartments (+5,7%). This stronger dynamism in house prices in Île-de-France has been observed since the 0,2th quarter of 4. In Paris, apartment prices remained almost stable over one quarter for the 2020rd consecutive quarter with –3%. Over one year, the prices of Parisian apartments are nevertheless down (–0,1%).

Pre-contracts

In mainland France, according to the projections at the end of February 2023 from the preliminary contracts, the slowdown in the rise in the price of existing housing should be significant at the end of February 2023: +4,6% over one year. The prices of old houses should still increase more than those of old apartments, but the differences should be less significant, with respectively +5,5% and +3,3% at the end of February 2023 (compared to +8,2% and +4% at the end of February). 3rd quarter 2022).

According to the prices from the preliminary contracts, we expect a price per m² of apartments of €10.500 in February 2023 in Paris. The very slight erosion of values would therefore continue in the capital, but without intensifying.

The rise in building costs, linked to inflation and particularly that of raw materials, to new environmental standards, to the scarcity of land pushed by the Zero Net Artificialisation (ZAN) fixed for 2050, not to mention the gradual loss of attractiveness of the Pinel system, lead the new home market to an economic impasse.

Credit - Banque de France data

In November, the CVS flow of new housing loans amounted to €18,3 billion (after €18,6 billion in October), while interest rates continued to rise, with an effective rate within the meaning of narrow –TESE –, ie excluding costs and insurance, by 1,91% on average (after 1,77% in October). The annual growth rate of outstanding housing loans was +5,7% in November, after +5,9% in October. The growth rate of consumer loans stood at +4,0%, after +4,3% in October.

The estimate put forward for December for new housing loans indicates a continued rise in the average interest rate, which should reach 2,04%, and a monthly CVS production of these loans at €15 billion. Over the year, the growth rate of outstanding housing loans should stand at +5,5%. Excluding renegotiations, adding the very first estimates for December, cumulative new loan production over the year would come out at €218,4 billion, i.e. a historic high apart from the exceptional year 2021, which 2022 is lower by 3% only.

Business premises in mainland France: a heterogeneous market concentrated in the areas of attraction of cities

The business premises market in mainland France is very heterogeneous. It is mainly made up of shops, with 45% of transactions taking place in 2021. Next come offices (16%), warehouses or furniture storage (15%), craft activities (12%) then medical activities (5%). ). The rest of the transactions concern both service stations and garages (3%) and hotels (3%). This breakdown by use has remained stable since 2017.

Only 6% of business premises transactions take place outside the city's attraction areas (AAV)[1]. Compared to 2017, the share of business premises transactions carried out in the city's attraction areas fell slightly in the central municipalities (40% against 43% in 2017) in favor of those carried out in the outer suburbs (34% against 32% in 2017). Civil real estate companies represent 60% of purchasers of business premises.

In 2021, in the areas of attraction of cities, 50% of offices will be acquired in the central municipalities (compared to 43% for all business premises). Compared to 2017, the share of offices acquired in the central municipalities and in the rest of the division decreased slightly in favor of the crowns, to 23% in 2021 against 20% in 2017.

Compared to 2019, the prices of offices acquired in the provinces in 2021 increased much more in the central municipalities (+21%) than in the rest of the areas of attraction of the cities (+8%). Over the same period, the median surface area of the main premises also increased in the central municipalities (from 106 to 113 m² in 2021), while it remained almost stable in the rest of the city's attraction areas.

Office prices are more heterogeneous in 2021. In the central municipalities, half of the offices were sold between around €90.000 and €300.000 in 2017 and 2019 compared to €100.000 to €390.000 in 2021. This phenomenon is also observed in the rest of the urban areas. attraction of cities from 2019.

[1] Breakdown defined by INSEE (www.insee.fr/fr/information/4803954) The municipalities have been grouped into 4 groups based on the categories defined in the Insee 2020 Urban Attraction Areas (AAV) zoning:

- Centres: “Centres” communes (the most populated within each AAV hub)

- Rest pole: other municipalities of the main pole and secondary poles of the AAV

- Crown: Commons of the crown of the poles of the AAV

- Excluding attraction: other municipalities not belonging to an AAV

In France, stocks have proven to be the best investment over the last 40 years

In France, stocks have proven to be the best investment over the last 40 years

Since Covid-19, the temptation to live near the sea, according to a study

Since Covid-19, the temptation to live near the sea, according to a study

The average rate of real estate loans starts to fall again in the 1st quarter, according to Crédit Logement

The average rate of real estate loans starts to fall again in the 1st quarter, according to Crédit Logement

Old property prices are still falling but a recovery is taking shape

Old property prices are still falling but a recovery is taking shape

A report on anticipating the effects of +4°C warming reaffirms the need for housing adaptation

A report on anticipating the effects of +4°C warming reaffirms the need for housing adaptation

AI is already revolutionizing businesses in architecture, engineering, construction... according to Autodesk's "State of Design & Make" study

AI is already revolutionizing businesses in architecture, engineering, construction... according to Autodesk's "State of Design & Make" study

What steps for an efficient energy transformation of the building?

What steps for an efficient energy transformation of the building?

HOQI revolutionizes real estate with its latest update: even more impactful photos to accelerate sales

HOQI revolutionizes real estate with its latest update: even more impactful photos to accelerate sales

Glass pergola: enjoy its outdoor spaces with elegance and modernity all year round

Glass pergola: enjoy its outdoor spaces with elegance and modernity all year round

Bjelin: wood and innovation as its DNA

Bjelin: wood and innovation as its DNA

Hydro'Way, Eco'Urba, StabiWay and Baltazar... permeable floor covering solutions from JDM Expert

Hydro'Way, Eco'Urba, StabiWay and Baltazar... permeable floor covering solutions from JDM Expert

A new low-carbon C2S1 glue enters the “Responsible & Sustainable” range offered by PRB

A new low-carbon C2S1 glue enters the “Responsible & Sustainable” range offered by PRB