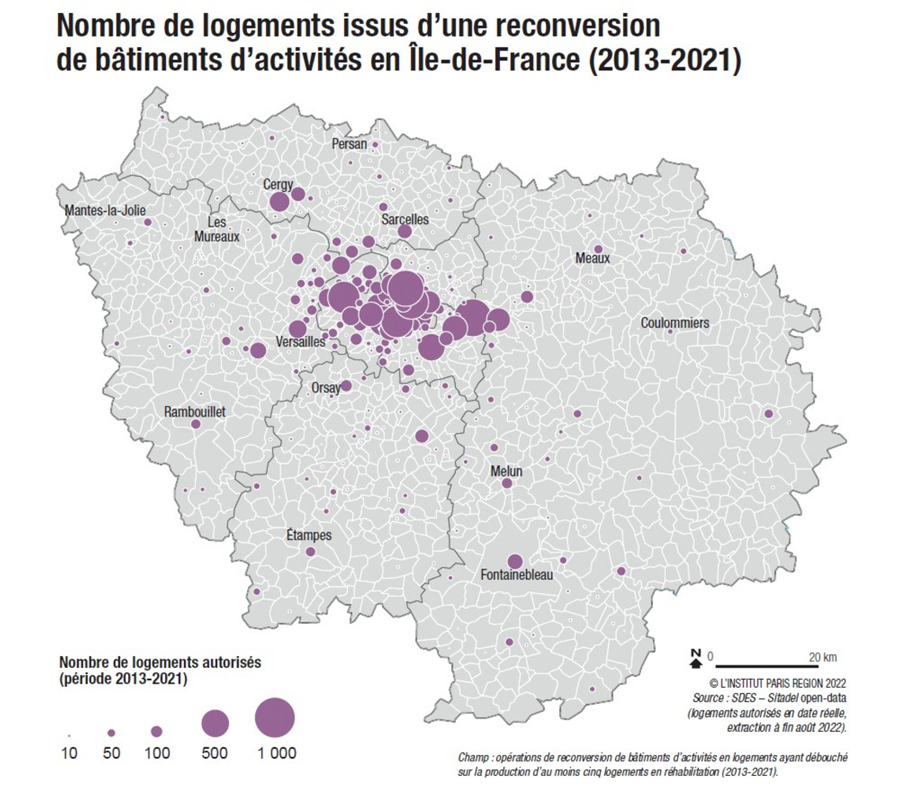

The reconversion of offices and business buildings is increasingly put forward by political actors and the media as one of the possible responses to the structural lack of housing in Île-de-France.

Selection of products

To read also

-

East-west inequalities persist within Greater Paris

East-west inequalities persist within Greater Paris

-

Public policies: the main remarks of the Court of Auditors in its annual report

Public policies: the main remarks of the Court of Auditors in its annual report

-

French housing mostly unsuitable for climate change, according to the Court of Auditors

French housing mostly unsuitable for climate change, according to the Court of Auditors

-

In Paris, energy consumption of social housing down 28% after renovation

In Paris, energy consumption of social housing down 28% after renovation

-

Ile-de-France residents find their region overpopulated, according to a survey

Ile-de-France residents find their region overpopulated, according to a survey

-

Top 20 cities most threatened by the ZAN law

Top 20 cities most threatened by the ZAN law

-

Living environment: a barometer revealing the current aspirations and concerns of the French

Living environment: a barometer revealing the current aspirations and concerns of the French

-

A report on the future of the National Agency for Urban Renewal (Anru) expected in June

A report on the future of the National Agency for Urban Renewal (Anru) expected in June

Popular News

-

The mortgage rate fell in February, for the first time in 1 years

The mortgage rate fell in February, for the first time in 1 years

-

Building and real estate: a sector plagued by crises but whose ecological transition is underway

Building and real estate: a sector plagued by crises but whose ecological transition is underway

-

As the world burns more fossil fuels than ever, persistent obstacles hamper the race for renewable energy

As the world burns more fossil fuels than ever, persistent obstacles hamper the race for renewable energy

-

The National Housing Agency announces a national France Rénov' tour with an official launch in Chartres on April 19, 2024

The National Housing Agency announces a national France Rénov' tour with an official launch in Chartres on April 19, 2024

Publi-editorial

-

Cero IV minimalist sliding door by Solarlux: light as the protagonist

Cero IV minimalist sliding door by Solarlux: light as the protagonist

-

A new low-carbon C2S1 glue enters the “Responsible & Sustainable” range offered by PRB

A new low-carbon C2S1 glue enters the “Responsible & Sustainable” range offered by PRB

-

Hydro'Way, Eco'Urba, StabiWay and Baltazar... permeable floor covering solutions from JDM Expert

Hydro'Way, Eco'Urba, StabiWay and Baltazar... permeable floor covering solutions from JDM Expert

-

Cleaning exterior wood: dedicated Owatrol solutions

Cleaning exterior wood: dedicated Owatrol solutions