The Altares group - long-standing expert and reference for information on companies - today unveils the figures for business failures in France for the 4th quarter and the whole of 2022.

The overall number of procedures remains however 10.000 below 2019 levels. Although the return to pre-Covid standards has been underway for a year, the increase in failures is accelerating alarmingly for SMEs, of which more than 3200 defaulted in 2022, with a third in the 4th quarter alone. Under these conditions, 143.000 direct jobs are now threatened.

For Thierry Millon, director of Altares studies: “Since 2020, 103.000 companies have defaulted compared to 162.000 during the previous three years. 59.000 failures were thus “spared” thanks in particular to the public aid systems deployed to deal with the consequences of the health crisis and then the war in Ukraine. However, if the risk has been anesthetized, avoiding the dreaded wave of bankruptcies, companies are not unscathed from these long months of turbulence. Between inflation and the energy crisis, the climate is becoming even more complicated and equity capital is being called upon. However, the Observatoire du Financement des Entreprises noted in its May 2021 report on the equity of VSEs and SMEs that while most of these companies faced the crisis with reinforced equity positions before Covid, some had , on the other hand, had very deteriorated financial structures (a third of VSEs) or was insufficiently capitalized (20% of SMEs analysed). For its part, the European Commission warns of the excessive weight of the debt of non-financial companies in the Union, which represented 111% of the GDP of the 27 at the end of 2020, or 14.900 billion euros. However, the handicapping lack of own funds to invest and finance is a preponderant signal of the risk of default. »

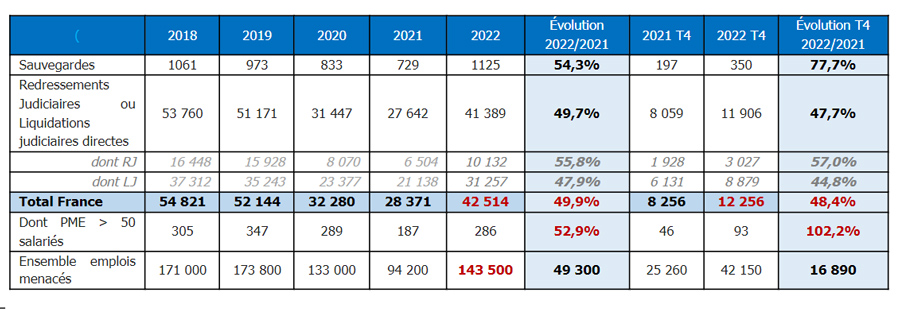

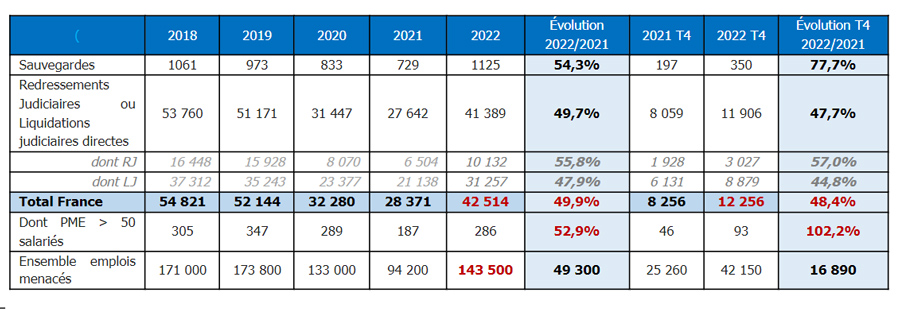

The volume of insolvencies still contained but the increase in openings shows a historic rate

With 42 procedures recorded, the volume of insolvencies has returned to its level of May 514. The increase over one year is exceptional (+2020%), an annual rate never before known which confirms the acceleration of the business claims .

The trend remained strong over the last quarter (+48%) after the surge in the summer (+70%) and the increases at the start of the year (+35% in the 1st quarter and +50% in the 2nd quarter) .

At the end of 2022, over twelve months, the number of openings remained 18% lower than that recorded at the end of 2019; a gap that is already only 9% in the last quarter alone, after a bad month of November already identical to that of 2019.

Number of business failures by type of procedure per year

Safeguards and recovery procedures are on the rise but remain in the minority

With 1.125 judgments pronounced in 2022, the number of safeguard proceedings is at its highest in five years. Up 54,3% over one year, its pace accelerated further in the fourth quarter (350; +73%). However, this system reserved for companies that are not in default still represents less than 3% of all procedures. At the end of January 2023, the courts should "only" pronounce the 6000th safeguard, a very derisory figure, 17 years after the entry into force of this procedure.

Reorganization proceedings (RJ) are increasing even faster. 10.132 judgments were pronounced, ie 55,8% more over one year. But less than one judgment in four (23,8%) is an opening of RJ, a rate well below the 30% observed before the crisis. Over the last quarter, the number of RJ (3027) is still rising rapidly, +57%.

Since the crisis, direct liquidations have become the norm

31.257 judicial liquidations (LJ) were opened (+47,9%) in 2022 and 8.879 (+44,8%) during the fourth quarter. Since 2020, the LJs have concentrated three quarters of the judgments pronounced against two thirds before Covid.

The short-lived crisis resolution treatment procedure remains anecdotal

Among these procedures, Altares distinguishes only 72 post-crisis treatments (PTSC) against 15 in 2021. This new procedure, which is similar to an express receivership, aims to facilitate the rebound of companies with fewer than twenty employees in cessation of payment but has the necessary funds to pay the wage claims. By 2021, 11 of the PTSCs involved had enabled the adoption of a plan aimed at ensuring the sustainability of the company. In 2022, 38 PTSC validated a clearance plan, 16 were finally converted into receivership and/or liquidation, while it is still too early to know the outcome of the files opened in November or December.

The number of jobs at risk rises above the 140.000 mark

The rise in insolvencies is affecting all sizes of business. However, the situation is particularly worrying for SMEs with 10 to 99 employees. 3.214 defaulted in 2022 compared to 1.804 in 2021, i.e. a surge of +78% over one year. The 4th quarter concentrates a third of these defaults (1.037), i.e. an increase of +93% compared to the same period in 2021 (538). This fourth quarter ends with the strongest deterioration recorded since 2014 (1163).

The largest companies are not spared since nearly a hundred (95) have been the subject of a procedure. The increase in procedures in this “segment” (+28%) is well below the global average (+50%).

Under these conditions, the number of jobs at risk jumps. Falling in 2021 below the 100.000 threshold, it increased very markedly and reached 143.500. This is nearly 50.000 more over one year but still 40.000 less compared to 2019.

B2C activities are at the forefront of the default front, but B2B is also under pressure

Construction

The construction sector, which concentrates a quarter of bankruptcies, goes back above 10.000 defaults with 10.033 open procedures, i.e. 33,6% more than in 2021. A trend below the national average (+49,9%) , driven by structural work (2.874; +22,8%) and in particular general masonry (+22,3%) and individual construction (+20,6%).

The second work, on the other hand, shows a rapid deterioration (4.932; +51,5%). This is particularly the case in insulation work (+94%) which has already returned to the level of failures of 2019 (208). Public works show an increase of 43,7% despite a relative resistance of current earthworks (+30,7%). Real estate development recorded the best performance (+12,4%) while the increase reached 41,9% in real estate agencies.

Trade

The trade is also approaching 10.000 defaults (9), up 418%.

It is in the retail trade that the trends are the most severe, particularly in multi-department (827; + 85%) and more particularly in groceries, where the number of failures has doubled in 2022 (635) thus already greatly exceeding that of 2019 (568). Food retail (990) is also weakened (+76,2%) and even more e-commerce (+79%) which now has more failures than in 2019 (739 against 543).

20% of failing merchants are in the sale and repair of vehicles (1871; + 36,7%).

Wholesale trade held up a little better (1873; +30,9%).

Services

In business services (5554), the increase is limited to +32,3%. However, some activities show severe changes. This is particularly the case for engineering, which now has more defects than in 2019 (598), but also for landscaping services, which recorded 374 procedures compared to 359 in 2019.

In services to individuals, the fragility is much more marked. They recorded 1.911 failures, an increase of 70,3%. A very rapid deterioration in hairdressing, beauty and body care activities (+87,9%).

Manufacturing

In the industry sector, business failures are increasing rapidly (+68%). 3083 procedures were opened, including 1314 in the food industry, including 874 bakers and pastry chefs (+124,7%).

In manufacturing, printing shows the strongest deterioration (182; +65,5%). Energy, water and environment activities (electricity production, waste water, waste) recorded a slightly lower increase (+49%).

Transport

More than a thousand (1079) freight carriers defaulted (+60,8%), only a hundred less than in 2019. 404 are intercity carriers (+58,4%), a number now very close to that observed in 2019 (415). 612 are local carriers (+63,6%), there were 693 in 2019.

Catering

4434 catering establishments defaulted in 2022, which is 112,7% more than in 2021. Over the last quarter, the pace has not weakened (+108%).

During the year 2022, 2473 traditional restaurateurs (+ 119,8%) and 1787 fast food establishments (+ 109%) entered the procedure as well as 803 drinking establishments (+ 101,3%). Accommodation holds up better (279; +23,5%).

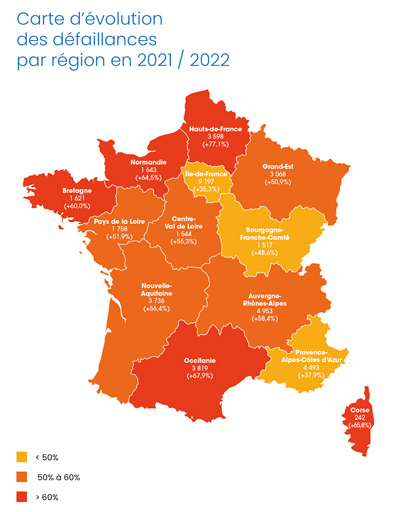

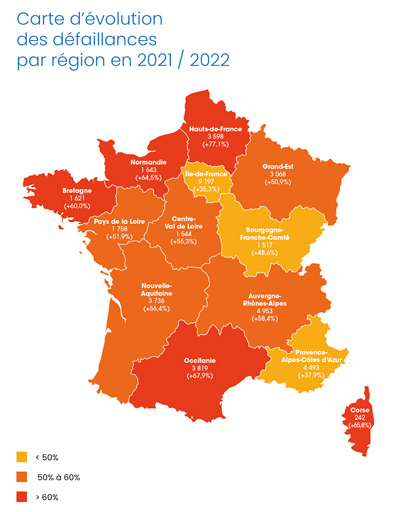

The resistance of Provençal and Ile-de-France companies slows down the national deterioration

One out of three failures is concentrated in Provence-Alpes-Côte-D'azur and Ile-de-France. In these two regions, the increase in procedures is contained below 40%, maintaining the national trend below the +50% mark.

In PACA, 4.493 procedures were opened, an increase of +37,9% over one year. They are 9.197 in Ile-de-France (+ 35,3%). In the fourth quarter, the pace does not accelerate.

In three regions the increase is close to 50%. Bourgogne-Franche-Comté (+48,6%), Grand-Est (+50,9%) and Pays-de-la-Loire (+51,9%). The first manages to reduce the increase to +22% over the last quarter, unlike the Grand Est where defaults soared by 67% at the end of the year.

Three other regions recorded increases of between +55% and +60%. These are Centre-Val-de-Loire (+55,3%), New-Aquitaine (+56,4%) and Auvergne-Rhône-Alpes (+58,4%). In each of these regions, the trend deteriorated further in the fourth quarter.

In four regions the increase is between +60% and +70%. This is the case for Brittany (+60%), Normandy (+64,5%), Corsica (+65,8%) and Occitania (+67,9%).

Hauts-de-France brings up the rear with a number of failures which soared by +77,1%. It should be noted, however, that the region is part of a better trend in the 4th quarter with an increase of 37,4%.

2023, a year of transition to be negotiated well

For Thierry Millon: “A year ago, we rejected the hypothesis of an explosion in defaults in 2022, anticipating despite everything a significant increase in defaults. If the cataclysm did not take place, the pace is more sustained than expected, raising fears of a return to pre-crisis values sooner than expected. 2019 ended with 52.000 failures, 2023 could exceed this threshold and bring us back to 2017 values above 55.000. A number certainly important but rather reasonable in view of the very difficult context that we are going through. For some VSEs and SMEs, the chances of survival are compromised. For some, the fragility of their financial structure is to blame. For others, it is paradoxically their inability to honor order books that are nonetheless well filled that could lead them to default. In question, the difficulties of supply, the explosion of the costs of materials and the problems of recruitment. In any case, lenders will be more demanding and will focus on companies with the strongest balance sheets. Financial constraints (repayment of Covid debts and in particular PGE; inflation; rate hikes; energy bills, etc.) are unfortunately destined to weigh ever more heavily. While the tensions on the treasuries of companies are already being felt, the financing of operations and therefore of the working capital requirement (WCR) will undoubtedly have the attention of the financial departments of VSEs, SMEs and ETIs. . »

[1] The Corporate Financing Observatory (OFE) is chaired by the National Credit Mediator. Report on the capital of VSEs and SMEs - May 12, 2021

[2] EPRS | European Parliamentary Research Service - Debt-equity bias reduction allowance (DEBRA) - Briefing 04-10-2022

[3] Post-crisis processing (PTSC), a new procedure that came into force on October 18, 2021 and should apply until June 1, 2023, is aimed at companies with fewer than twenty employees with over the last financial year total liabilities excluding equity of less than €3 million. They are statistically confused with receiverships.

Methodology : Altares business failure statistics include all legal entities with a SIREN number (sole proprietorships, liberal professions, companies, associations) and having been the subject of a judgment to initiate proceedings pronounced by a Commercial or Judicial Court (ex TGI - TI)

Glossary: The business failure corresponds to the opening of a procedure of safeguard, judicial recovery or direct judicial liquidation with a Commercial or Judicial Court. This also concerns openings after resolution of the recovery plan. On the other hand, the default statistics do not take into account either amicable procedures (Adhoc mandate or conciliation) or the aftermath of opening (termination of plan or conversion into liquidation).

The average rate of real estate loans starts to fall again in the 1st quarter, according to Crédit Logement

The average rate of real estate loans starts to fall again in the 1st quarter, according to Crédit Logement

Old property prices are still falling but a recovery is taking shape

Old property prices are still falling but a recovery is taking shape

The mortgage rate fell in February, for the first time in 1 years

The mortgage rate fell in February, for the first time in 1 years

Executives are investing more than before in the outskirts of cities, according to a study

Executives are investing more than before in the outskirts of cities, according to a study

Is the investment in stone going against the wall?

Is the investment in stone going against the wall?

How is the purchasing power of the French in new real estate evolving?

How is the purchasing power of the French in new real estate evolving?

Real estate: borrowers have gained up to 9m² of purchasing capacity over the last 6 months

Real estate: borrowers have gained up to 9m² of purchasing capacity over the last 6 months

Positive balance of 57 new factories in France in 2023 after 49 in 2022, according to Lescure

Positive balance of 57 new factories in France in 2023 after 49 in 2022, according to Lescure

Building and real estate: a sector plagued by crises but whose ecological transition is underway

Building and real estate: a sector plagued by crises but whose ecological transition is underway

A report on anticipating the effects of +4°C warming reaffirms the need for housing adaptation

A report on anticipating the effects of +4°C warming reaffirms the need for housing adaptation

Laurent Galloux, new director of Sika France

Laurent Galloux, new director of Sika France

Future of Plaza on M6: the outgoing boss of the channel says he is waiting for the judgment

Future of Plaza on M6: the outgoing boss of the channel says he is waiting for the judgment

Glass pergola: enjoy its outdoor spaces with elegance and modernity all year round

Glass pergola: enjoy its outdoor spaces with elegance and modernity all year round

EduRénov Plan: Rockwool unveils its Guide to successful energy renovation of school buildings

EduRénov Plan: Rockwool unveils its Guide to successful energy renovation of school buildings

Hydro'Way, Eco'Urba, StabiWay and Baltazar... permeable floor covering solutions from JDM Expert

Hydro'Way, Eco'Urba, StabiWay and Baltazar... permeable floor covering solutions from JDM Expert

Create, modify and reuse with Block Walls

Create, modify and reuse with Block Walls